Contents

To accomplish this, a trader can buy or sell currencies in the forwardor swap markets in advance, which locks in an exchange rate. For example, imagine that a company plans to sell U.S.-made blenders in Europe when the exchange rate between the euro and the dollar (EUR/USD) is €1 to $1 at parity. Currencies are important because they allow us to purchase goods and services locally and across borders. International currencies need to be exchanged to conduct foreign trade and business. Once an investor has learned about the ins and outs of currency trading on the FX market, the next steps would be to choose a forex broker and open a forex trading account.

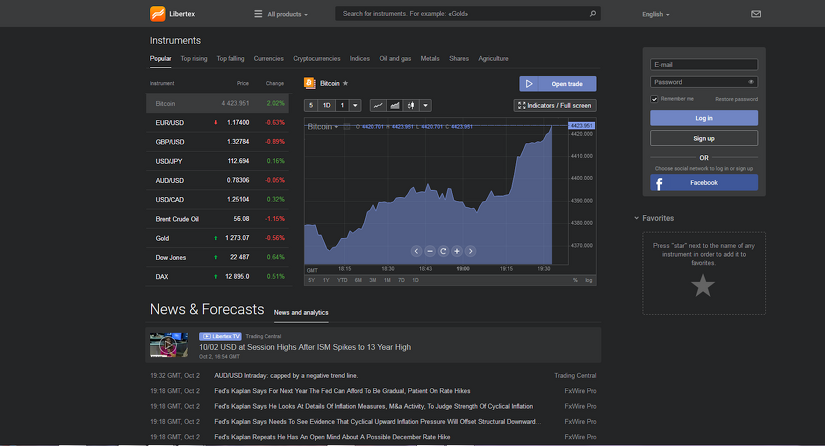

A forex trading signal can provide prompts to help determine entry and exit points for a given forex market. These signals can be determined by either manual or automated methods. Manual methods involve looking at chart patterns and averages to determine buy and sell opportunities. Automated methods use algorithms that determine trading signals and execute trades based on several pre-set conditions.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. While we adhere to strict editorial integrity, this post may contain references to products from our partners.

The first step to forex trading is to educate yourself about the market’s operations and terminology. Next, you need to develop a trading strategy based on your finances and risk tolerance. Today, forex algorithmic trading it is easier than ever to open and fund a forex account online and begin trading currencies. Countries like the United States have sophisticated infrastructure and markets to conduct forex trades.

The forex market has high liquidity, due to an elevated supply and demand rate. Traders apply transactions based on financial events, as well as general events. Naturally, when a currency will be on a high demand, its value will raise comparing to the other currencies, and vice versa.

Going short

Instead the forex market is run by the global network of banks and other institutions. With no central location forex markets trade continually around the world, and trades can be conducted 24 hours a day from all corners of the globe. Because most traders will never take physical delivery of the currency, they are trading derivatives are used to trade price changes in the markets. This allows a trader to speculate on price movements without taking ownership of the asset. Other2.2%Total200.0%There is no unified or centrally cleared market for the majority of trades, and there is very little cross-border regulation.

Bankrate.com does not include all companies or all available products. He has previous experience as an industry analyst at an investment firm. Baker is passionate about helping people make sense of complicated financial topics so that they can plan for their financial futures. Start with small amounts as you’re learning so that any mistakes don’t wipe you out. As you gain more experience, you’ll be able to increase position sizes and recognize trends more quickly. Forex trading is fairly simple in concept, but that doesn’t mean you’ll make money trading currencies.

¿Cuál es la Mejor Plataforma de Trading de Forex?

They may even choose to specialise in just a few select currency pairs, investing a lot of time in understanding the numerous economic and political factors that move those currencies. FX traders take advantage of this by becoming extremely receptive to market news releases and then trade based upon the suspected market sentiment. FX is an industry term that is abbreviated from forex, and is commonly used instead of forex. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Foreign exchange is the process of changing one currency into another for a variety of reasons, usually for commerce, trading, or tourism. According to a 2019 triennial report from the Bank for International Settlements , the daily trading volume for forex reached $6.6 trillion in 2019. It’s important to know that the spot FX rate and forward FX rate for a given currency pair are usually not the same, and that these rates can differ substantially. For example, EUR/USD may be quoted at 1.18 for a spot rate, but 1.20 for a 6-month forward rate. This means EUR 1 million could be purchased for USD $1.18m today, although it would cost USD $1.20m to arrange settlement for 6 months from now.

Understanding Currency Pairs

You can follow along with these examples using a free City Index demo account. The minor pairs consist of all the currencies listed above, but crossed with each other instead of engulfing candle rules USD. The major pairs are EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF and USD/CAD. A reserve currency is a currency held in large quantities by governments and institutions.

This trade represents a “direct exchange” between two currencies, has the shortest time frame, involves cash rather than a contract, and interest is not included in the agreed-upon transaction. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. In developed nations, state control of foreign exchange trading ended in 1973 when complete floating and relatively free market conditions of modern times began. Other sources claim that the first time a currency pair was traded by U.S. retail customers was during 1982, with additional currency pairs becoming available by the next year. U.S. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency system. After the Accord ended in 1971, the Smithsonian Agreement allowed rates to fluctuate by up to ±2%.

Investopedia does not include all offers available in the marketplace. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

A Brief History of Forex

Due to the over-the-counter nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. This implies that there is not a single exchange rate but rather a number of different rates , depending on what bank or market maker is trading, and where it is. Due to London’s dominance in the market, a particular currency’s quoted price is usually the London market price. Major trading exchanges include Electronic Broking Services and Thomson Reuters Dealing, while major banks also offer trading systems. A joint venture of the Chicago Mercantile Exchange and Reuters, called Fxmarketspace opened in 2007 and aspired but failed to the role of a central market clearing mechanism. This is the primary forex market where those currency pairs are swapped and exchange rates are determined in real-time, based on supply and demand.

Put differently, it indicates how much 1 unit of the base currency is worth in the quote currency. Forex is an abbreviation of ‘foreign exchange’ the name for the marketplace in which individuals can buy and sell world currencies. It’s how individuals, businesses, central banks, and governments pay for goods and services in other countries. Including why foreign exchange is such a popular market, how to buy and sell currencies, the types of forex pair and more.

These companies’ selling point is usually that they will offer better exchange rates or cheaper payments than the customer’s bank. These companies differ from Money Transfer/Remittance Companies in that they generally offer higher-value services. Around 25% of currency transfers/payments in India are made via non-bank Foreign Exchange Companies. Most of these companies use the USP of better exchange rates than the banks. They are regulated by FEDAI and any transaction in foreign Exchange is governed by the Foreign Exchange Management Act, 1999 . The foreign exchange market is a global decentralized or over-the-counter market for the trading of currencies.

The first currency is known as the ‘Base’ and the second currency is known as the ‘Quote’. For instance, if you were to buy the EUR/USD currency pair, it means you are buying euros while selling dollars. Should the euro strengthen against the dollar, then you would make a profit. Conversely, should the euro fall against the dollar, then you would lose money.

You can deposit funds and trade blindly, but that’s not a recipe for success. We encourage you to take advantage of all of our trading tools and resources, insights, technical and fundamental analysis to enhance the efficacy of your forex trades. Know what drives the markets, apply sound principles, and trade with confidence.

Is learning forex hard?

While the forex market can be complex and may require some study for traders to become familiar with it and trade successfully, getting involved in forex trading is relatively simple. All one needs to start trading is a bit of capital, brokerage account, computing power and internet connectivity.

A carry trade occurs when you buy a high-interest currency against a low-interest currency. For each day that you hold that trade, your broker will pay you the interest difference between the two currencies, as long as you are trading in the interest-positive direction. A currency pair is simply the two currencies you trade against one another side by side, identified as a three-letter abbreviation for each currency.

1 The Foreign Exchange Market

Trading forex presents some unique challenges that you might not be familiar with if you’ve only traded stocks or ETFs. The variables that drive forex trading and changes in exchange rates are different from those that drive stock prices. You’ll likely need to pay more attention to the macroeconomic factors for the countries whose currencies you’re trading. Things like GDP growth, trading deficits and interest rates can play a big factor in exchange rates.

For most currency pairs—including, for example, the British pound/U.S. Dollar (GBP/USD)—a pip is equal to 1/100 of a percentage point, or one basis point. That means that for every $1 margin you have in your account, you can place a trade in a major currency pair worth up to $50. So, whether you’re new to online trading or you’re an experienced investor, FXCM has customisable account types and services for all levels of retail traders. Other than the margin, you also pay a spread, which is the difference between the ‘buy’ and the ‘sell’ price of an asset. To open a long position, you’d trade slightly above the market price and to open a short position, you’d trade slightly below the market price .

GBP

Derivative trading can provide opportunities to trade forex with leverage. As this can be a risky process, forex traders often choose to carry out forex hedging strategies, in order to offset any currency risk and subsequent losses. One unique aspect of this international market is that there is no central marketplace for foreign exchange. This means that when the U.S. trading day ends, the forex market begins anew in Tokyo and Hong Kong.

If a central bank wants to decrease inflation, it can increase interest rates in a bid to stop spending and lending. This generally increases the value of money in an economy, as there is less, or ‘more expensive’, money available in the economy. When going to a store to buy groceries, we need to exchange one valuable asset for another – money for milk, for example. The same goes for trading forex – we buy or sell one currency for the other. The currencies in the pairs are referred to as “one against another”.

From 1970 to 1973, the volume of trading in the market increased three-fold. At some time (according to Gandolfo during February–March 1973) some of the markets were “split”, and a two-tier currency market was subsequently introduced, with dual currency rates. The spread is the difference between the buy and sell prices quoted ufx trading central for a forex pair. Like many financial markets, when you open a forex position you’ll be presented with two prices. If you want to open a long position, you trade at the buy price, which is slightly above the market price. If you want to open a short position, you trade at the sell price – slightly below the market price.

If you lose more money than your initial deposit, your account could go negative and your broker may ask you to repay it. Before using leverage you should fully understand the risks involved, and what you could end up losing. This is because compared to standard trading, the risks are magnified and you can stand to lose more than just your initial deposit, which could be money you can’t afford.